Graph O Fthe Sock Market From 1900

Although long-run stock market data are an important indicator, obtaining them is challenging. This column constructs new long-run broad-based indices of equities traded on British securities markets for the period 1829-1929 and combines them with a more recent index to examine the timing of British business cycles and compare returns on home and foreign UK investment. One finding is that the capital gains index of blue-chip companies appears to be a good bellwether of macroeconomic behaviour.

Stock market indices around the world are near historic highs. During the past ten years, the FTSE 100 has almost doubled, the DAX trebled, and the S&P500 quadrupled. Including dividends, the returns are even higher. With uncertainty over trade wars, Brexit, and other economic and political headwinds, how much could asset prices fall? Can investors buying today still expect high returns in the future?

History may give us some insights into these questions. For financial economists, long-run stock market data can help to assess the equity risk premium (Dimson et al. 2007, Goetzmann and Ibbotson 2007), market efficiency and asset pricing (Le Bris et al. 2019, Mirowski 1987, Ito et al. 2016), and asset bubbles (Shiller 1989, 2000, Frehen et al. 2013).

The challenge for researchers is the availability of high quality long-run stock market data. For the US, the Centre for Research in Security Prices dataset from 1926 onward is the standard source. Prior to this date, Goetzmann et al. (2001) have constructed an index back to 1815, while other spliced indices reach back to 1800 (Cowles 1939, Smith and Cole 1935).

Dimson et al. (2002) constructed an annual index for the UK beginning in 1900. However, the preceding Victorian era is also very interesting, as during this period the UK led the world in terms of technology, political influence, and financial development. In a recent paper (Campbell et al. 2019), we analyse market performance during this time, by constructing new long-run broad-based indices of equities traded on British securities markets for the period 1829-1929.

Data

The data used to calculate these indices constitute the largest, most comprehensive monthly database ever compiled on British share markets during the century prior to the onset of the Great Depression. We use the Course of the Exchange and the Investor's Monthly Manual to collect more than one million security-month observations on over 5,800 securities representing about 4,500 companies.

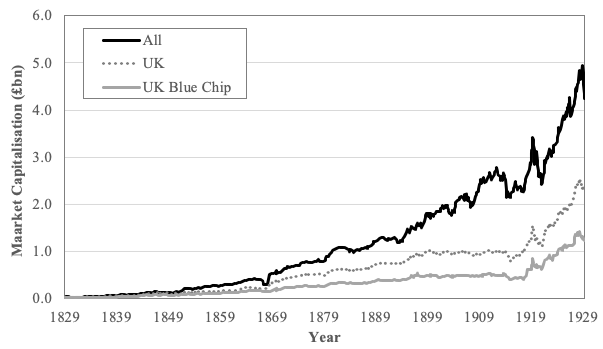

The data show that the UK share market grew rapidly during the period under consideration and became increasingly international in scope (Figure 1). For the first 50 years of the sample period, transportation (first canals, then railways) and finance dominated the equity market. This dominance diminished after the 1870s, but these two broad sectors still constituted about 40% of market capitalisation of the sample in 1929. The development of new industries as well as flotations of established private firms in sectors such as brewing, iron, coal, and steel explain much of the growth of the share market between 1879 and 1929.

Figure 1 Total market capitalisation of common shares in the sample, 1829-1929

Price indices, 1829-1929

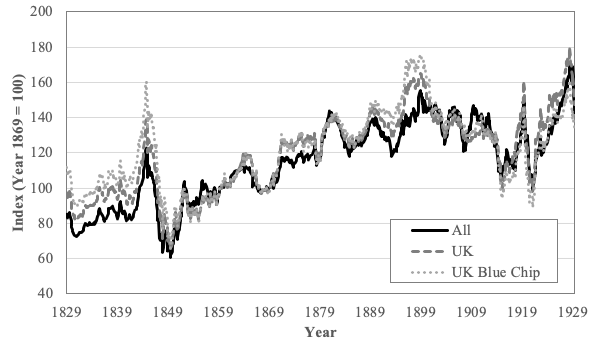

We construct three indices of capital appreciation each weighted by market capitalisation, from 1829 to 1929: an all-share index; a UK-share index, which is composed solely of domestic firms; and a blue-chip index, which consists of the largest 30 domestic stocks in each year.

Figure 2 reveals several substantial fluctuations in these price indices. The largest percentage decline in the UK index occurred during 1845-1850, following the collapse of the Railway Mania, when the index fell by 53%. Large declines occurred during the post-World War I slump (39%), during the early stages of the Great Depression in 1929 (18%), and following the crashes associated with Overend Gurney in 1866 (19%), the City of Glasgow Bank in 1878 (11%), and the Baring crisis in 1890 (12%). The most dramatic market advances took place during the 1842 to mid-1845 Railway Mania (52%), from 1915 to 1920 (61%), and during the seven years prior to the 1929 crash (84%).

Figure 2 Capital gains indices, 1829-1929

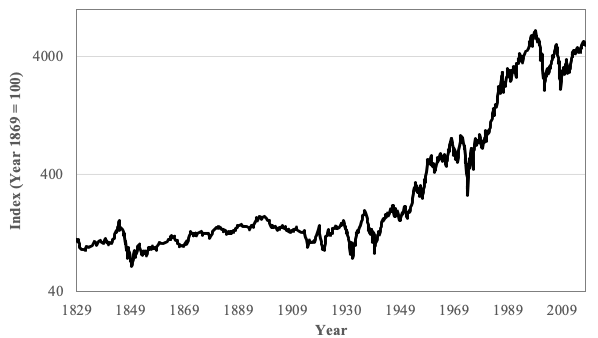

The blue-chip index, 1829-2018

The Investor's Monthly Manual ceased as a publication in 1930 and our indices therefore stop at this point. However, another index known as the FT30 runs from that era to the current day. The FT30 is not ideal, as it uses the geometric average of each company's return to calculate the return of the index, but it is highly correlated with other indices such as the FTSE100. We splice our end-of-month blue-chip index on to the end-of-month values of the FT30, to create a monthly blue-chip index for the UK stock market from 1829 to 2018, shown in Figure 3.

Figure 3 Monthly blue-chip capital gains index, 1829-2018

By 1940, the blue-chip index had fallen to below where it stood in 1829, but then began an upward trajectory that persisted until 1999. This 60-year-period witnessed a nearly 80-fold increase in the blue-chip index. This pattern is similar to Goetzmann et al.'s (2001) findings for the US. Three things may account for this performance. First, companies in the modern era have paid out smaller dividends and investors have received more of their returns via capital gains (Grossman and Shore 2006). Second, the demise of the gold standard and then the Bretton Woods arrangement resulted in much higher inflation in the post-1940 world, which translates into higher nominal returns. Third, companies, and therefore their equities, simply performed better in the six decades after 1940.

There have been at least seven sharp contractions in the stock market from 1829 to 2018 according to the blue-chip index: 1845-1849, 1920-21, 1929-1932, 1937-1940, 1972-1974, 2000-2002, and 2008-2009. All the contractions have been associated with major economic downturns, except for those of 1845-49 and 2000-02, which were associated with the ends of new technology booms on the stock market, i.e. railways and the internet.

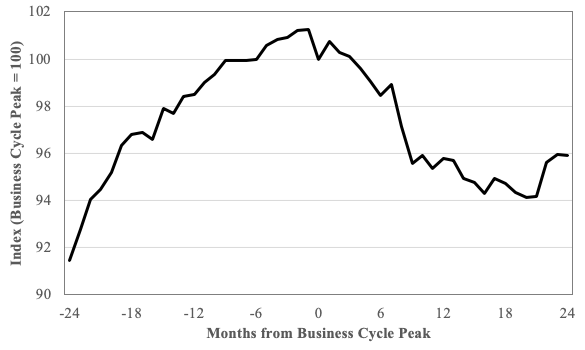

Can we use these stock market indices to understand British macroeconomic fluctuations over the long run? We use Chadha et al.'s (2000) catalogue of business cycle peaks and troughs from 1857 to 1954, and the OECD indicators on reference turning points from 1955 to 2018. We construct business cycle diagrams in the style of Burns and Mitchell (1946). For each of the business cycles, we rebase the blue-chip index to be 100 at the cycle peak and then focus on the four-year period around this point. We then take the average value of the rebased index each month across all of the business cycles (Figure 4).

Figure 4 Blue-chip index performance over the business cycle, 1857-2018

The capital gains index of blue-chip companies appears to be a good bellwether of macroeconomic behaviour. During the two years prior to the business cycle peak, the index increases by an average of 10.7%. The index peaks one month before the peak of the business cycle, and then declines steadily thereafter. The index bottoms out 20 months following the cyclical peak, losing an average of about 7.0% from its peak value.

Equity premium

Although capital gains are a useful measure of share price fluctuations, investors are most interested in total returns, that is, capital gains plus dividends. The total return for the 100-year period between 1829 and 1929 averaged 5.4% per year for all equities, 5.3% for UK equities, and 4.9% for the blue-chip UK equities, with almost all of this coming from dividends.

Inflation during this period averaged just under 0.4% per year, so real returns would have been about 5.0%. The average return on prime bills during this period was about 3.5%, so the equity premium was just over 1.9%. These are quite modest compared to recent experience – between 1968 and 2017, real returns were 6.4% and the equity premium over bills was 4.8% (Dimson et al. 2018, p. 35).

The early decades of the sample period (i.e. the 1830s and 1840s) have amongst the lowest capital gains, dividend yields, and total returns. The early years of the modern share market, given their frequent boom and busts, were not remunerative for investors. However, investors that were still in the market during the 1850s enjoyed the highest capital gains and total returns of any decade. Returns were quite low around the start of the twentieth century, but the next two decades had the largest dividend yield of any decade and slightly above average total returns.

Further research

The results presented here should represent the most complete monthly indices for 19th and early 20th century British share markets created to date. The indices are included in our paper's appendix and could be useful in a wide range of contexts for future research in economic history and financial economics.

References

Burns, A F and W C Mitchell (1946), Measuring business cycles, New York: National Bureau of Economic Research.

Campbell, G, R S Grossman and J D Turner (2019), "Before the cult of equity: New monthly indices of the British share market, 1829-1929", CEPR discussion paper 13717.

Chadha, J S, N Janssen and C Nolan (2000), "An examination of UK business cycle fluctuations: 1871-1997 - supplementary paper", Cambridge working papers in Economics 0024, Faculty of Economics, University of Cambridge.

Cowles, A (1939), Common-stock indexes, Bloomington, IN: Principia Press.

Dimson, E, P Marsh and M Staunton (2007), "The worldwide equity premium: A smaller puzzle", in Mehra, R (ed), Handbook of the equity risk premium, p. 467-514, Amsterdam: Elsevier.

Dimson, E, P Marsh and M Staunton (2018). Credit Suisse global investment returns yearbook 2018, Zurich: Credit Suisse Research Institute.

Frehen, R G P, W N Goetzmann and K G Rouwenhorst (2013), "New evidence on the first financial bubble", Journal of Financial Economics 108(3): 585-607.

Goetzmann, W N, R G Ibbotson and L Peng (2001), "A new historical database for the NYSE 1815 to 1925: Performance and predictability", Journal of Financial Markets 4(1): 1-32.

Goetzmann, W N and R G Ibbotson (2007), "History and the equity risk premium", in Mehra, R (ed), Handbook of the equity risk premium, p. 515-529, Amsterdam: Elsevier.

Grossman, R S and S Shore (2006), "The cross section of stock returns before World War I", Journal of Financial and Quantitative Analysis 41(2): 271-294.

Ito, M, A Noda and T Wada (2016), "The evolution of stock market efficiency in the US: A non-Bayesian time-varying model approach", Applied Economics 48(7): 621-635.

Le Bris, D, W N Goetzmann and S Pouget (2019), " The present value relation over six centuries: The case of the Bazacle company", Journal of Financial Economics 132(1): 248-265.

Mirowski, P (1987), "What do markets do? Efficiency tests of the 18th-century London stock market", Explorations in Economic History 24(2): 107-129.

Shiller, R J (1989), Market volatility, Cambridge: MIT Press.

Shiller, R J (2000), Irrational exuberance, Princeton: Princeton University Press.

Smith, W B and A H Cole (1935), Fluctuations in American business, 1790-1860, Cambridge: Cambridge University Press.

Graph O Fthe Sock Market From 1900

Source: https://voxeu.org/article/new-monthly-indices-british-stock-market-1829-1929

0 Response to "Graph O Fthe Sock Market From 1900"

Post a Comment